Building a Seamless Tax Filing Experience at Compound Planning

Case Study

My role: UX Strategy, End-to-End Journey and UI Design

Timeline: 7 weeks

Background

Compound Planning is a wealth management platform that helps clients track their net worth, optimize finances, and plan for major life events. As part of its services, Compound historically supported tax filing through outsourced CPA firms.

In 2025, Compound expanded its tax model to better serve clients across different levels of complexity by partnering with April (for embedded, simpler filings) and external firms like WhyBlu and Track (for more advanced cases).

This expansion surfaced three problems…

Problem 1

Lack of Transparency with Outsourced Firms

Clients working with external CPAs didn’t know:

Which firm was handling their return.

What the status or timeline of their filing was.

This weakened trust, increased confusion, and burdened support teams.

Solution Direction

Create a client-facing status page showing the assigned firm, filing status (e.g., started, in progress, complete), and key dates.

Problem 2

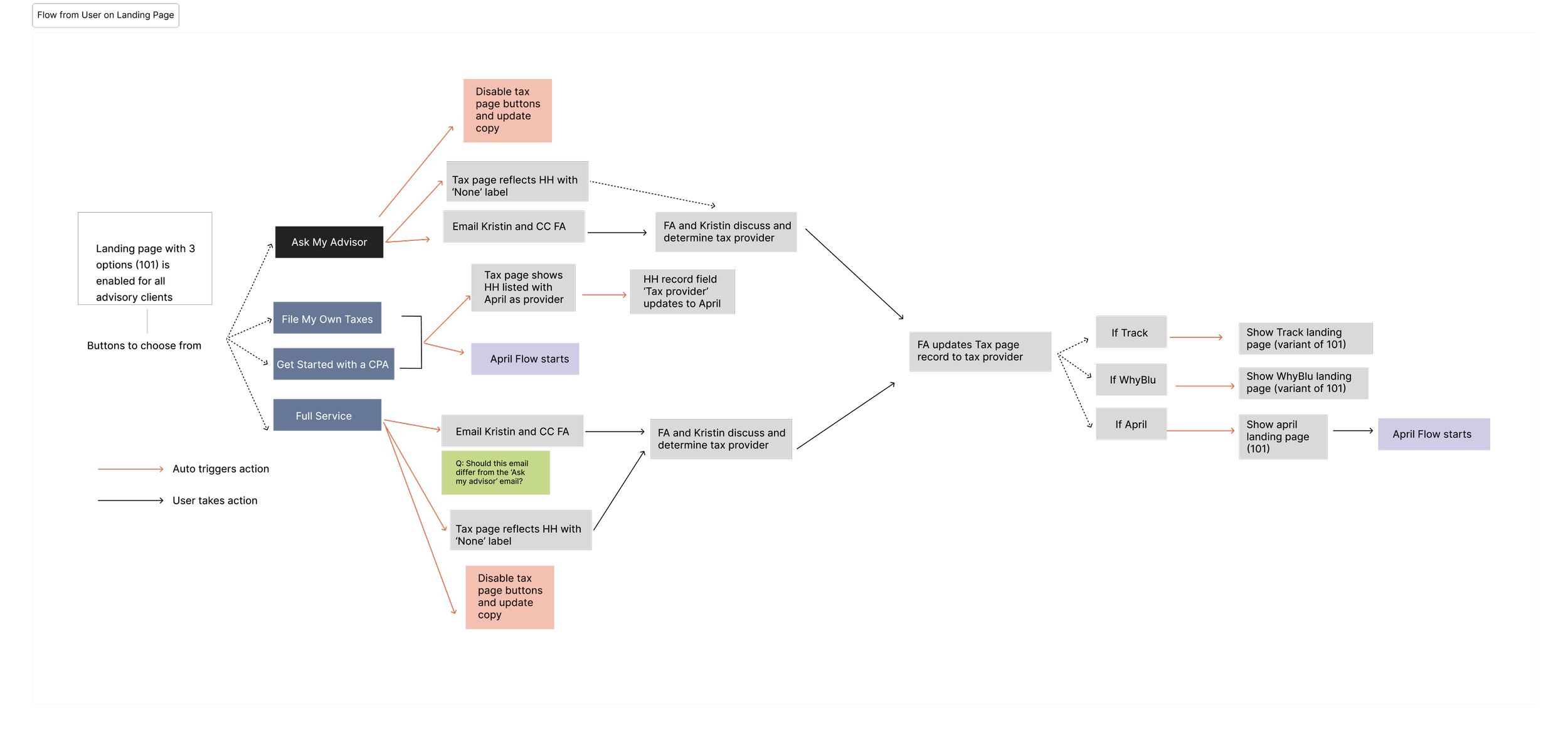

Client Discovery and Filing Navigation

Clients without an assigned filing method needed:

Clear visibility into available filing options.

A seamless way to start the embedded April flow if eligible.

Solution Direction

Design a tax “Discovery Page” to explain filing paths, encourage eligible clients to file with April, or request CPA support if needed.

Problem 3

Internal Advisor Tracking and Assignment

Advisors needed:

A way to track which firm each client was filing with.

The ability to pre-assign clients based on complexity (saving clients the effort of choosing incorrectly).

Solution Direction

Build an internal tax table in AdvisorHQ to assign filing partners, track filing status, and monitor client progress.

Research Approach

User research: Reviewed past client support tickets related to tax filing confusion.

User interviews: Conducted interviews with advisors and the Head of Tax to understand pain points.

Competitive research: Explored competitor tax firm websites to identify patterns in UI design

Design Solutions

Client Experience Design: Landing Pages and Filing Flows

Discovery Landing Page:

Explained available filing options clearly.

Offered instant access to April’s embedded filing flow for simple returns.

Provided a "Request a Quote" option for clients needing CPA support.

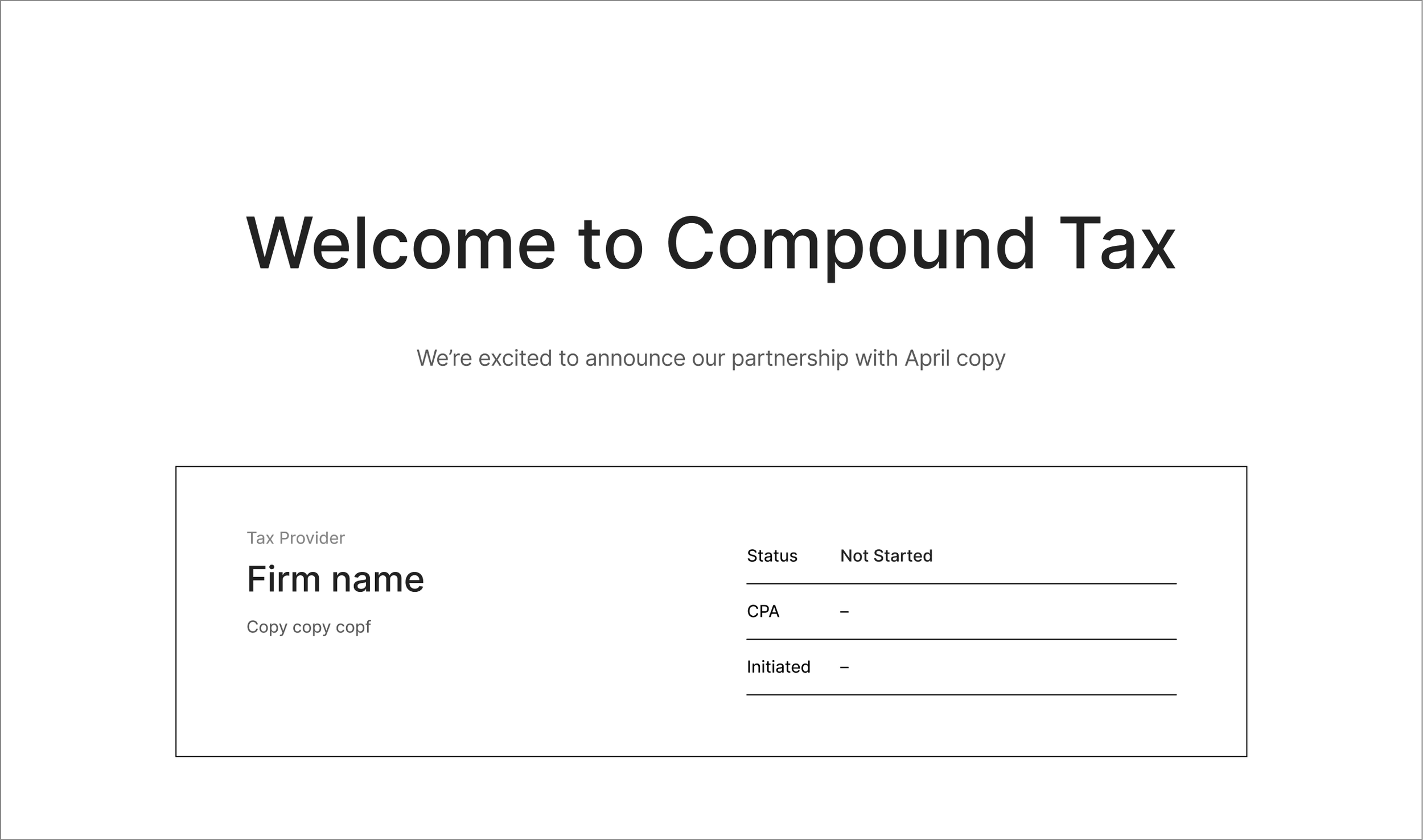

Outsourced Firm Status Page:

For clients using WhyBlu, Track, or other firms.

Showed firm name, start date, and current return status.

Increased transparency and reduced advisor-client friction.

Embedded April Experience:

Co-branded April landing page within the Compound dashboard.

Tracked real-time filing status (e.g., started, submitted, approved).

Designed for clients pre-assigned to April or who self-initiated April filings.

Advisor Experience Design: Internal Tools

Advisor Tax Table: Assign and Track Clients

Advisors could assign the correct filing partner based on known client complexity.

Pre-filtered clients already linked to WhyBlu to prevent conflicting options.

Allowed tracking client status, firm assignment, filing stage, AGI, and state.

Individual Client Record:

Gave advisors visibility into key metadata for each return.

Enabled proactive support during tax season.

My Role

Working within the company’s existing design system and legacy branding, I produced low-fidelity wireframes that guided early design direction.

In addition:

Conducted user research though interviews, and competitive analysis.

Created user flows, wireframes, and prototypes to visualize the end-to-end experience.

Facilitated weekly feedback loops with the Head of Design, PMs, engineers, and the Head of Tax to drive collaborative decision-making.

Led usability testing with Engineering, Design and CPA stakeholders.

Partnered closely with the Head Designer to deliver high-fidelity designs, address edge cases and ensure UX consistency across the product.

Results & Outcomes

Seamless Embedded Filing for April Clients: Clients experienced a modern, integrated way to file taxes without leaving the Compound dashboard — a major step forward in trust and ease.

Clear Advisor Oversight: Internal tools helped advisors assign the right partner and proactively support clients.

Reduced Support Load: Clients were better routed, received clearer instructions, and had greater transparency — reducing back-and-forth during a typically high-stress season.

Scalable System: The flexible architecture allows for future CPA firms to be added, expanding the offering without overwhelming users with incompatible choices.

Takeaway

This project showed how critical clear pathways and transparency are when financial data and major life tasks are involved.

Key learning: When introducing multiple service options, client education and subtle guardrails are essential to reduce decision fatigue and avoid costly errors.

Future iterations will focus on smarter advisor alerts, expanded filing analytics, and deeper client education at the discovery stage..